Real estate investments are a great way to generate extra income and build equity in your portfolio. The benefits of real estate include recurring income, appreciation in value, tax benefits and diversification of your portfolio. To determine if real estate is the right investment for you, you should consider both its pros and cons.

Benefits of becoming a real estate agent

A career in real estate can be an exciting and rewarding experience for people who enjoy working with the public and helping others find homes or invest in property. You could also earn substantial commissions.

It's possible to work remotely, allowing you to choose your own schedule. You can work whenever you like. Some people may find this a big benefit, because it allows them to spend more quality time with their families.

Careers in real estate are a great opportunity to earn money if one is willing to work hard and stay abreast of the latest trends. It is important to distinguish yourself from other real estate agents if you wish to become known in the area and attract people who are looking to purchase or sell property.

It's not easy to get into the real estate industry. You should carefully consider whether this is right for you. It's important to do your research and get the support you need before you make a decision, so you can be sure that this is the right career for you.

Careers in real estate are also a good way to develop your reputation as a professional. You will have the opportunity to create your own personal brand. This can be crucial for your career and success.

You can acquire a range of skills: from dealing directly with clients and buyers to managing properties and negotiating agreements. You'll have to know the laws and regulations governing the field and be willing to invest time in learning about your local market.

It's not easy to choose the right career, but investing in real estate is a profitable and rewarding investment for those who are determined and driven to succeed. This is a great opportunity to build a solid reputation in the community.

It's hard to tell if the stock market is rising or falling, and it may take a while for your investment to become profitable. However, if you're diligent and do your research, it's possible to increase the value of your real estate investments, which can boost your cash flow and help you grow your savings.

FAQ

Are flood insurance necessary?

Flood Insurance covers flooding-related damages. Flood insurance can protect your belongings as well as your mortgage payments. Find out more information on flood insurance.

What should you look for in an agent who is a mortgage lender?

People who aren't eligible for traditional mortgages can be helped by a mortgage broker. They look through different lenders to find the best deal. There are some brokers that charge a fee to provide this service. Others offer free services.

Should I use a mortgage broker?

Consider a mortgage broker if you want to get a better rate. Brokers have relationships with many lenders and can negotiate for your benefit. Some brokers receive a commission from lenders. Before you sign up for a broker, make sure to check all fees.

How much does it cost for windows to be replaced?

Replacing windows costs between $1,500-$3,000 per window. The total cost of replacing all your windows is dependent on the type, size, and brand of windows that you choose.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to become real estate broker

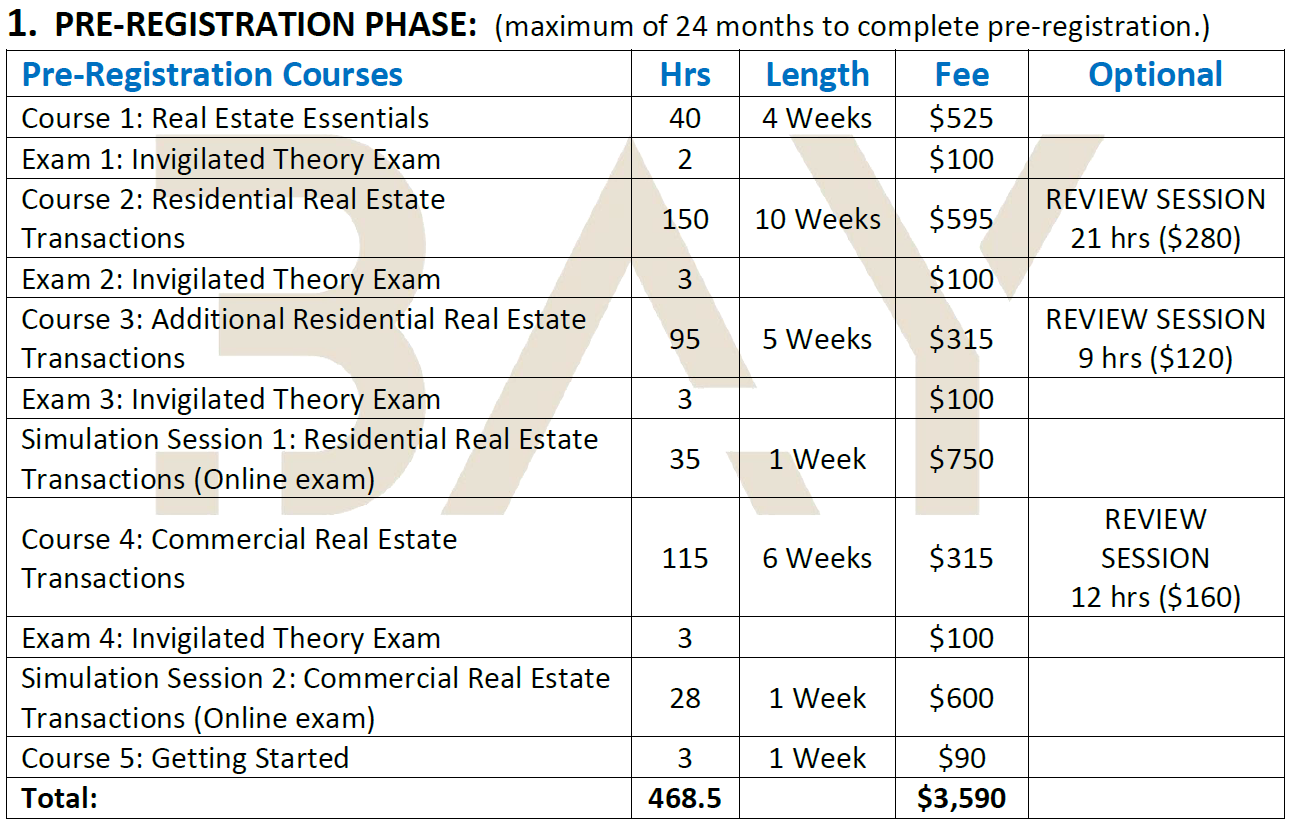

Attending an introductory course is the first step to becoming a real-estate agent.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This involves studying for at least 2 hours per day over a period of 3 months.

After passing the exam, you can take the final one. To become a realty agent, you must score at minimum 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!