Negotiating realtor fees is an essential part of any home-buying or selling process. A real estate agent's fee can amount to thousands of dollars, so it's important to know how to save on this cost. A reduction in the fee paid by your agent can help you to reduce closing costs and make sure that your sale goes smoothly.

To negotiate fees for realtors, you must first understand the market. You should gather information on homes that are comparable to yours in terms of price, location, and condition. You can also ask your agent questions about his services. You will be able to determine the type of services your agent offers as well as his commission rate. Zillow allows you to get a good idea of the market for local housing.

A high-priced home may allow you to lower your commission. This is especially true for those who live in an area that is highly-seller. However, you won't always get a higher rate. Additionally, an agent who is less experienced may want to increase sales. This will make it more difficult to lower the commission.

Next, you must justify the lower rate. It's possible that your agent will object to your property not selling as quickly or as quickly as you'd like. You'll need more work if there are fewer buyers.

A final tip is to bring a number with you to work. This will increase your chances of success. A 4.5% commission is a better option than the standard 66%. This will save you a staggering $3899 in realtor fee costs.

You should also learn to use your own personal knowledge and market research to convince your realtor that the fee you're offering is reasonable. You can negotiate the price of your home, in addition to lowering your agent's commission. The purchase of a home is one the largest financial transactions that you will ever make. If you are willing to spend the time and effort necessary to get a higher price on your home, it will be worth it.

Another option is to use a dual-agent, which means the same agent represents both the buyer as well as you. This allows you to reach a wider range of potential buyers and can result is a higher asking price. However, this isn’t allowed in every state. It can also increase the risk for your agent.

If your realtor is unwilling to negotiate your fee, you might be able to negotiate a discounted rate by listing your property in the winter or fall. While these times are less popular, you can still expect a lower price.

FAQ

Can I get another mortgage?

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is used to consolidate or fund home improvements.

Are flood insurance necessary?

Flood Insurance covers flooding-related damages. Flood insurance can protect your belongings as well as your mortgage payments. Learn more about flood coverage here.

What should I look for when choosing a mortgage broker

A mortgage broker helps people who don't qualify for traditional mortgages. They look through different lenders to find the best deal. This service is offered by some brokers at a charge. Other brokers offer no-cost services.

What is the cost of replacing windows?

The cost of replacing windows is between $1,500 and $3,000 per window. The total cost of replacing all of your windows will depend on the exact size, style, and brand of windows you choose.

What is a "reverse mortgage"?

A reverse mortgage lets you borrow money directly from your home. It allows you to borrow money from your home while still living in it. There are two types available: FHA (government-insured) and conventional. With a conventional reverse mortgage, you must repay the amount borrowed plus an origination fee. FHA insurance covers repayments.

What should you look out for when investing in real-estate?

It is important to ensure that you have enough money in order to invest your money in real estate. You will need to borrow money from a bank if you don’t have enough cash. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

Also, you need to be aware of how much you can invest in an investment property each month. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

Also, make sure that you have a safe area to invest in property. You would be better off if you moved to another area while looking at properties.

Should I use a mortgage broker?

If you are looking for a competitive rate, consider using a mortgage broker. Brokers work with multiple lenders and negotiate deals on your behalf. Some brokers receive a commission from lenders. Before signing up, you should verify all fees associated with the broker.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

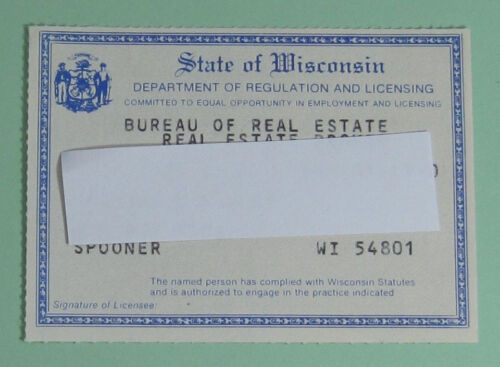

How to become an agent in real estate

You must first take an introductory course to become a licensed real estate agent.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This requires that you study for at most 2 hours per days over 3 months.

Once this is complete, you are ready to take the final exam. In order to become a real estate agent, your score must be at least 80%.

You are now eligible to work as a real-estate agent if you have passed all of these exams!