The purchase of a house can be very emotional. A bad decision is the last thing you want. This is why it is so important to look at the three main elements before you offer.

It is important to know what your budget can afford before you submit an offer. While this is not a hard and fast rule, if you are looking to purchase a home, you should always keep your budget in mind.

An experienced real estate agent can help you decide what to offer and what price to pay. You will need to consider the property's current condition, local housing market and seller's needs in order to make the most favorable offer. To give the seller time to prepare for the sale, it is important to include a closing date in the offer.

Another important part of the equation is the seller's response to your offer. The seller might refuse to accept it, or they might allow a bidding war to ensue. Depending on the circumstances, you may be able to recoup some or all of your down payment by agreeing to a different closing date. You can ask the seller for repairs if you want.

Remember that the listing price will affect the amount of an offer. If the home is being offered for sale by a realtor, you will need to decide if you would prefer to deal with the agent directly or to have an independent broker negotiate the deal. A real estate attorney should be consulted if you're not buying a house with your own money.

The real estate market in your area is probably more competitive than you think. There might be an opportunity to purchase the house of dreams at a great price. This could be as simple as offering less than your budget, or it could mean you can offer more than the asking.

Your agent can help you make an offer. Your agent is not just an expert in realty, but can help you find the ideal home at the most affordable price. Make sure you research the neighborhood and the school districts. This will give you an advantage over your competition.

A professional real estate agent will answer all your questions and help you decide what and how much to sell. It is important to act quickly if you want the house that you dream of. This is one decision you will never regret. Your real estate agent can be the best friend you have during this process.

These tips can help you make an offer that is accepted. If you have the right planning and luck, you will be the new owner.

FAQ

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans have higher initial fees than adjustable-rate ones. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

What should you think about when investing in real property?

It is important to ensure that you have enough money in order to invest your money in real estate. You can borrow money from a bank or financial institution if you don't have enough money. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

You also need to make sure that you know how much you can spend on an investment property each month. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

Finally, ensure the safety of your area before you buy an investment property. It is best to live elsewhere while you look at properties.

How long does it take to get a mortgage approved?

It is dependent on many factors, such as your credit score and income level. It typically takes 30 days for a mortgage to be approved.

Can I buy a house without having a down payment?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include conventional mortgages, VA loans, USDA loans and government-backed loans (FHA), VA loan, USDA loans, as well as conventional loans. For more information, visit our website.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

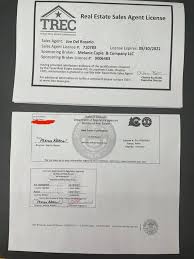

How to become an agent in real estate

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This involves studying for at least 2 hours per day over a period of 3 months.

This is the last step before you can take your final exam. To become a realty agent, you must score at minimum 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!